At certain points this year the S&P 500 has been up 8% and down 30% from where it finished 2019. It’s currently up around 8% on the year.

The Nasdaq 100 has been up as much as 43%, down as much as 20% and currently sits at a 35% gain in 2020.

The Russell 2000 Small Cap Index has been up as much as 2% in 2020, down as much as 40% and currently sits at basically breakeven for the year.

The stock market has been all over the map this year.

And while 2020 is an outlier in terms of the wild ups and downs, volatility is something every investor is going to have to get used to in the coming years. You simply have to be willing to accept some form of volatility if you would like to earn anything on your capital. Volatility has always been part of the markets but more so now than at any other time in history because interest rates are on the floor.

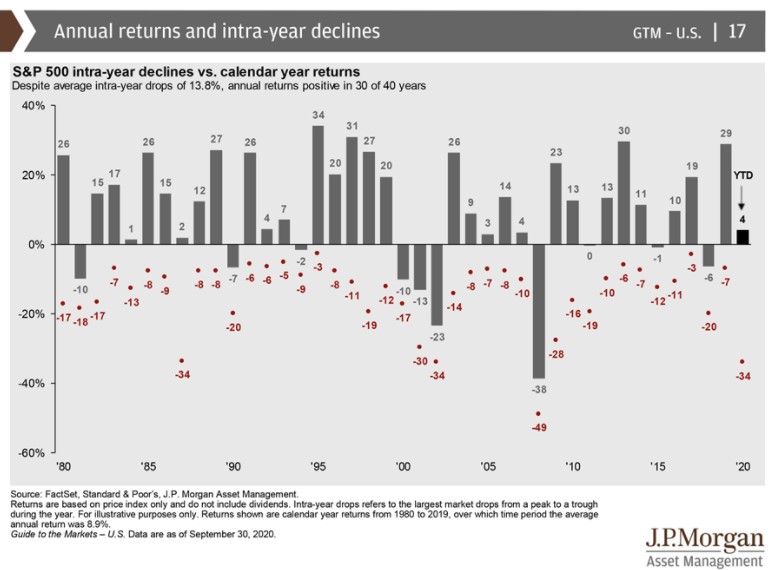

I’ve always loved this chart from JP Morgan that compares the biggest peak-to-trough drawdowns each year on the S&P 500 to the total return for that year:

It’s a little eerie how similar the 2020 profile looks like 1987.

Look at that gap in 2020. Stocks were down 34% peak-to-trough back in March yet now the market is up on the year.

In 23 out of the 41 years listed here there has been a double-digit correction intra-year. In 12 of those 23 years, the market actually finished the year in positive territory. And in 8 of those 23 years, the stock market finished the year with double-digit gains.

There’s a good chance these enormous differences in returns between gains and losses in a given year will continue for the foreseeable future.

Interest rates are pushing people out on the risk spectrum. The Fed is more entrenched in the markets than ever before. And there are millions of investors out there who not only want, but need, to earn higher returns on their capital. There are retirees who don’t have enough money saved for retirement and pension funds without enough capital to cover their obligations.

All of these factors could lead to some interesting allocations decisions in the years ahead.

And it’s not just the stock market where investors will need to become more comfortable accepting volatility.

This is true if you’re investing in bonds as well.

The Bloomberg Barclays Aggregate Bond Index, which is a good proxy for many of the total bond market index funds, currently has a yield of 1.2% and a duration of nearly 6 years. What this tells us is you could expect to earn that 1.2% annually over the next 6 years.

This also means for every 1% rise (fall) in rates, you could expect to see a 6% loss (gain).

These relationships aren’t written in stone but it’s pretty close.

And the volatility would be far greater in a longer maturity fund. The iShares 20+ Year Treasury Bond ETF (TLT) currently yields around 1.3% with a duration of 19 years. That means a 1% rise (fall) in rates would lead to a 19% loss (gain).

So even if the long-term returns of bonds end up being fairly close to current rates, the path to get there could be rocky depending on the movement of rates between now and then.

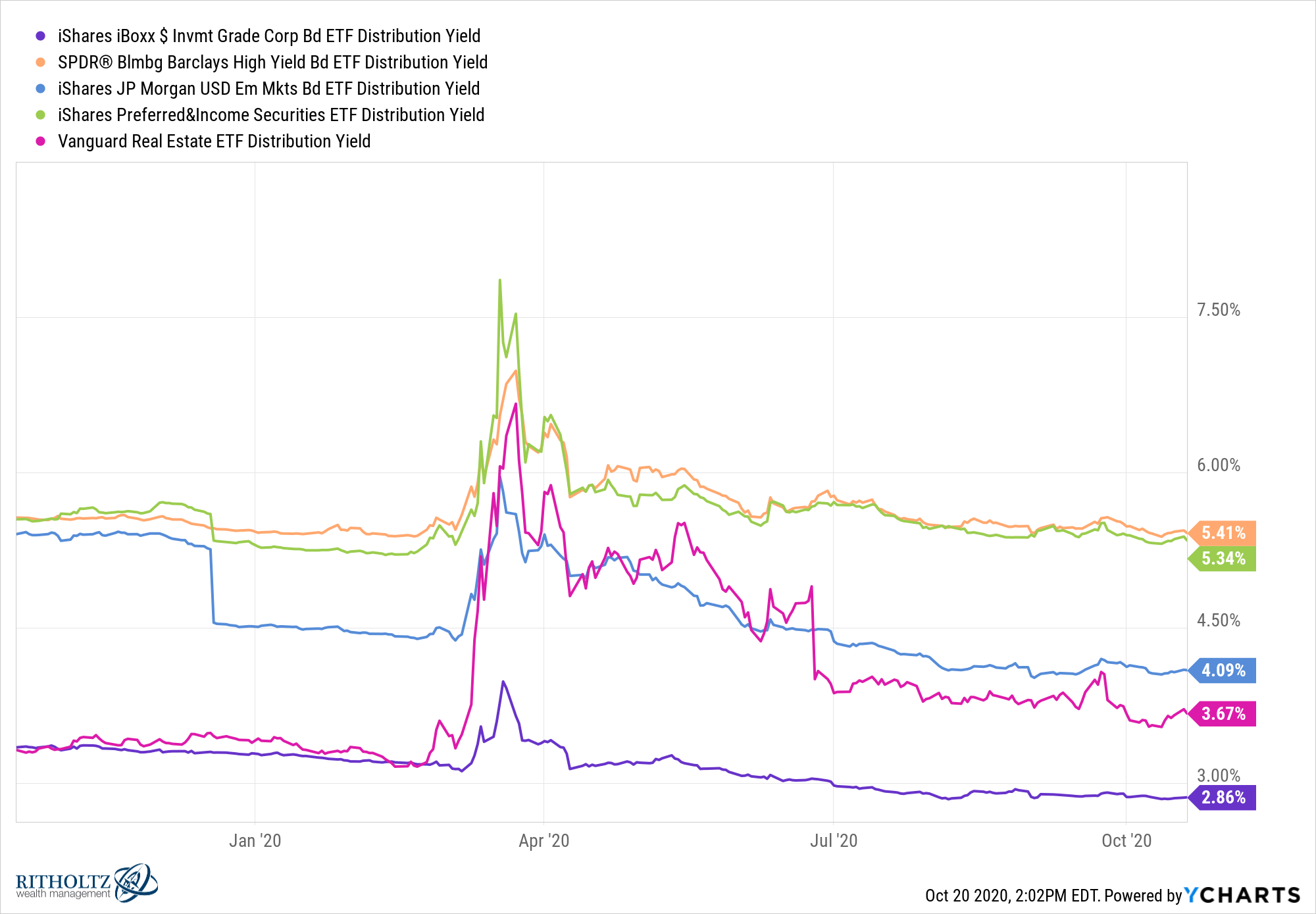

If those yields are too low for your taste there are other options that pay higher income:

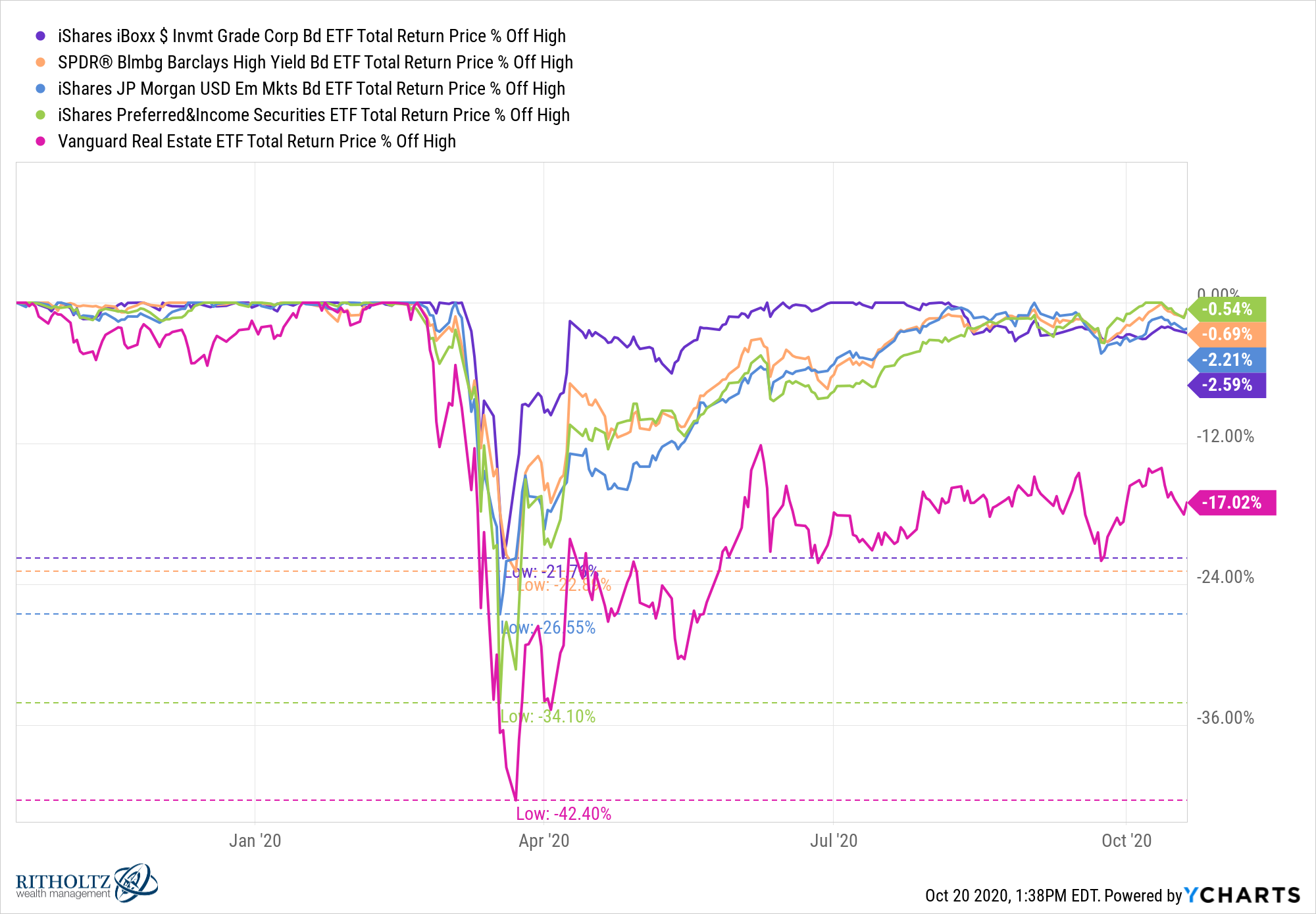

You just have to be aware that the other side of these higher yields is a higher chance of loss for these funds. These are the drawdowns on corporate bonds, junk bonds, emerging market bonds, preferred stocks and REITs this year:

Losses ranged from more than 20% to more than 40%. Again, 2020 has seen extreme volatility but it’s important to remember higher yields come with higher risk.

Really the only answer to volatility is to have your money sit in cash and earn nothing.

If you want to earn anything on your money you have to learn to live with volatility.

Further Reading:

Massive Up and Down Moves in Stocks in the Same Year Are More Common Than You Think